You are using an outdated browser. Please upgrade your browser to improve your experience.

You can put your own videos into the programming mix. If you have TV commercials, youtube videos, or even a podcast that you've produced we can feature them in between the network content we provide. We've foud that simply showing your own videos "on loop" back to back isn't as effective as mixing them into fresh up-to-date TV content. That's why we mix them in! You can choose how often you want your videos to be shown and we handle it for you.

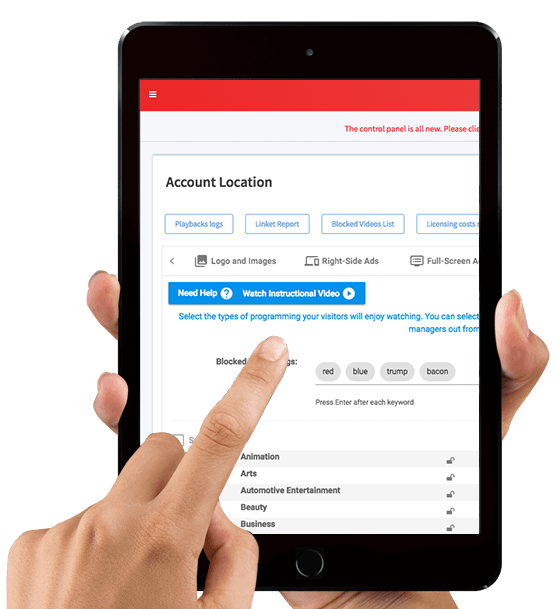

With our convenient native iPhone/iPad apps, and our responsive website that works on any smart phone or tablet you'll always have immediate control. Change the video content, upload new promotions, syndicate your social media, add new videos and more– all from the palm of your hand.

Whether it's from cable TV or another custom provider, businesses are making the switch to It's Relevant. We've become the go-to for medical offices, car dealerships, malls, sports/entertainment complexes, hotels, restaurants, residential properties, salons, retail outlets, waiting rooms and more. We are the best solution for creating a positive customer experience and connecting with people. For this reason we operate across many industries.

per box for 2+ boxes

or $112/month for a single box

per box for 2+ boxes

or $68/month for a single box

net cost to business

While our system is very easy to use and most of our clients never need "help", we are here not only for tech support, but to help you strategize how to best utilize your TV for your business. For this reason, every one of our valued clients are assigned a Client Success Manager. Available to you via phone, email, and Facetime/video chat, this person is dedicated to making sure you are getting the most out of your TV.

One of our experts will take you through a live demonstration, and help you to come up with a strategy to make your TVdo more for you and your visitors.